Minnesota Annualized Income Installment Worksheet Minnesota

If you do not receive your income evenly throughout the year (for example, your income from a repair shop you operate is much larger in the summer than it is during the rest of the year), your required estimated tax payment for one or more periods may be less than the amount figured using the regular installment method. The annualized income installment method annualizes your tax at the end of each period based on a reasonable estimate of your income, deductions, and other items relating to events that occurred from the beginning of the tax year through the end of the period. To see whether you can pay less for any period, complete the 2012 Annualized Estimated Tax Worksheet ( Worksheet 2-6).

Nuvvu Naaku Nachchav (నువ్వు నాకు నచ్చావ్) Telugu Movie Songs Jukebox|| Venkatesh, Arthi Agarwal - Duration: 29:18. Aditya Music 1,662,516 views 29:18. Cinebay nuvvu naku nachav.

Any special programs you may have managed. Wisconsin caregiver career program.

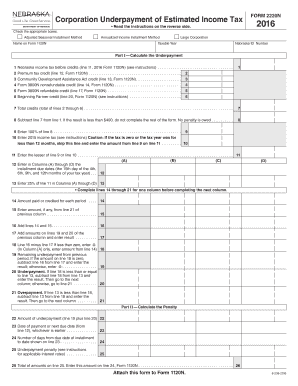

Ments using the annualized income installment method. Complete the work‑ sheet on the back of Schedule M15. The annualized income installment work‑ sheet automatically selects the smaller of the annualized income installment or Do I need to file Schedule M15? Use this schedule to determine if you owe a penalty for underpaying estimated tax.

Use Figure 2-C to help you follow these instructions. See for another worksheet available for your use. The purpose of this worksheet is to determine your estimated tax liability as your income accumulates throughout the year, rather than dividing your entire year's estimated tax liability by four as if your income was earned equally throughout the year. The top of the worksheet shows the dates for each payment period. The periods build; that is, each period includes all previous periods. After the end of each payment period, complete the corresponding worksheet column to figure the payment due for that period. If you file Form 1040, add the tax from Forms 8814, 4972, and 6251 for the period.

If you file Form 1040A, add the amount from the Alternative Minimum Tax Worksheet found in the instructions. Also include any recapture of an education credit for each period. You may owe this tax if you claimed an education credit in an earlier year and you received either tax-free educational assistance or a refund of qualifying expenses for the same student after filing your 2011 return. Use the 2011 forms or worksheets to see if you will owe any of the taxes discussed above. Figure the tax based on your income and deductions during the period shown in the column headings.

Multiply this amount by the annualization amounts shown for each column on line 2 of the 2012 Annualized Estimated Tax Worksheet ( Worksheet 2-6). Enter the result on line 13 of this worksheet. • You will have federal income tax withheld from wages, pensions, annuities, gambling winnings, or other income, or • You would be required to make estimated tax payments even if you did not include household employment taxes when figuring your estimated tax. • Amounts on Form 1040 written in on the line for “ other taxes” (line 60 on the 2011 Form 1040).

But do not include recapture of a federal mortgage subsidy; tax on excess golden parachute payments; look-back interest due under section 167(g) or 460(b) of the Internal Revenue Code; excise tax on insider stock compensation from an expatriated corporation; uncollected social security, Medicare, or RRTA tax on tips or group-term life insurance; or additional tax on advance payments of health coverage tax credit when not eligible. • Repayment of the first-time homebuyer credit if the home will cease to be your main home in 2012. See Form 5405 for exceptions. • 25% (.25) for the first period, • 50% (.50) for the second period, • 75% (.75) for the third period, and • 100% (1.00) for the fourth period.

However, you may choose to include your withholding according to the actual dates on which the amounts will be withheld. For each period, include withholding made from the beginning of the period up to and including the payment due date. You can make this choice separately for the taxes withheld from your wages and all other withholding. For an explanation of what to include in withholding, see Total Estimated Tax Payments Needed—Line 16a, earlier. • 72% for column (b). • 45% for column (c).